“If it costs more, it must be better for the country,” said no one ever. Yet here we are, merrily slapping fees on goods like it’s a national sport. Welcome to the world of tariffs – where prices rise, and nobody’s happy. Let’s break it down, shall we?”

What Are Tariffs, Anyway?

To put it simply, tariffs are taxes. But unlike the ones you’re painfully familiar with every April, tariffs are a special type of tax. They’re not on your income, your home, or even that questionable coffee habit. No, tariffs are taxes on imports, a way for the government to raise money by making imported goods more expensive.

The idea is fairly straightforward: if it costs you more to buy a product from overseas, you’ll be more inclined to buy the same (hopefully cheaper) product from within the U.S. Voila! Tariffs are seen as a magical way to protect American businesses by encouraging us to buy American.

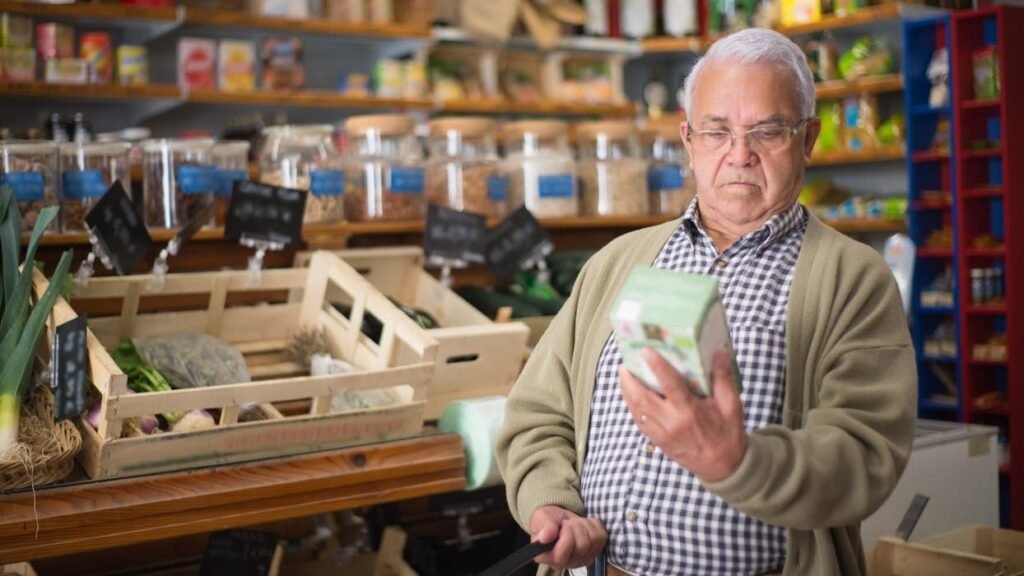

However, the reality is a bit more…complicated. When tariffs are imposed, they’re like the bouncer at the club, saying, “Hey, if you want to get in, you’re going to have to pay up.” Only, instead of paying to get into a club, you’re paying to get that fancy European cheese or shiny smartphone. And who ultimately pays that price hike? We do. The everyday consumer.

Why Do We Use Tariffs?

Tariffs aren’t just about money; they’re about power, politics, and good old-fashioned persuasion. Here are the big reasons tariffs get slapped onto imports:

- Protecting U.S. Industries: The government imposes tariffs to give a helping hand to American companies struggling to compete with cheaper international goods. Think of it as a protective bubble – only instead of keeping them safe from germs, it keeps them safe from cheaper competitors.

- Retaliation: If another country decides to play hardball, the U.S. may respond with its own tariffs. It’s like a playground fight but with billions of dollars at stake.

- Revenue Generation: Tariffs bring in cash. (Though in the grand scheme, it’s just a tiny drop in the ocean of U.S. federal revenue.)

- Political Messaging: Sometimes, tariffs serve as a way for politicians to prove they’re “tough on trade.” So, the next time someone campaigns on “putting America first,” just remember, there’s probably a tariff hiding somewhere in that message.

The “Benefits” of Tariffs

Sure, tariffs have their benefits. They’re supposed to protect U.S. jobs and keep our industries afloat. Theoretically, they can encourage us to buy domestically, which sounds good if you’re a cheerleader for American manufacturing. But those benefits come with a rather large price tag. For starters, tariffs create a ripple effect. When the price of imports goes up, businesses that rely on imported materials (think cars, electronics, clothing) start charging more to cover their costs.

So while tariffs can theoretically keep jobs in America, the effect on the average American’s wallet? Not so friendly.

Tariffs in Action: Some Real-Life Examples

Remember the 2018 trade war with China? The U.S. put tariffs on hundreds of billions of dollars’ worth of Chinese goods. In retaliation, China put tariffs on U.S. goods like soybeans, pork, and even bourbon. For American farmers, it was like getting hit with a “thank you for your service, here’s a pay cut.” Prices for U.S.-grown crops fell, and suddenly, what was supposed to be a move to protect American interests started backfiring.

And let’s not forget the tariffs on steel and aluminum. Intended to boost the domestic metals industry, they ended up raising costs for U.S. manufacturers, driving up prices on everything from beer cans to cars.

But Who Really Pays for These Tariffs?

Here’s the punchline: tariffs are supposed to make foreign companies pay, but the burden almost always lands on American consumers and businesses. When the U.S. imposes a tariff, say on steel from Canada, the Canadian company selling steel doesn’t usually eat the cost. Instead, the U.S. companies buying that steel pay more, and they pass that cost on to you – yes, you – the consumer.

Think of tariffs as a tax dressed up in international relations talk. Politicians can call it “leveling the playing field,” but all it really means is you’ll be paying more for everyday items.

Are Tariffs Really Effective?

This is where it gets interesting. Tariffs can be effective – if the goal is to create short-term gains or, in some cases, force another country to the negotiation table. However, economists aren’t always so convinced. History has shown that long-term tariffs can be a game of diminishing returns.

Take the famous Smoot-Hawley Tariff Act of 1930. Its goal? Protect American businesses during the Great Depression. The result? Other countries hit us with their own tariffs, global trade slowed to a crawl, and the U.S. sank even deeper into economic turmoil. It’s a lesson we apparently need to keep relearning.

The Bottom Line

In the grand scheme, tariffs are one of those political tools that sound great on paper but often end up costing more than they give. They can help protect certain industries, but they usually leave consumers – you know, us – holding the bill. So next time you see a politician waving the tariff flag, just remember: the goal may be to hit foreign companies, but the only thing that’s actually guaranteed to take a hit is your wallet.

In conclusion:

Tariffs may sound like a bold power play, but they’re essentially a tax on our own spending.